To be a Doctor. Is it worth it? A Financial Analysis

I was in the middle of what I can only describe as a "Stress Dream" (why? you'll see below) the other night: It seemed to be some crappy, poorly run hospital, but it was also an auction house, and the attending physician was selling my organs to the highest bidder to cover my student loan interest. I woke up in a cold sweat, clutching my left kidney and wondering if I could get by with just one. Had to watch some TikTok videos and some brain rot to feel normal again at 2 in the morning(I mean, I should've reviewed Anki deck, but gotta have some life, right?).

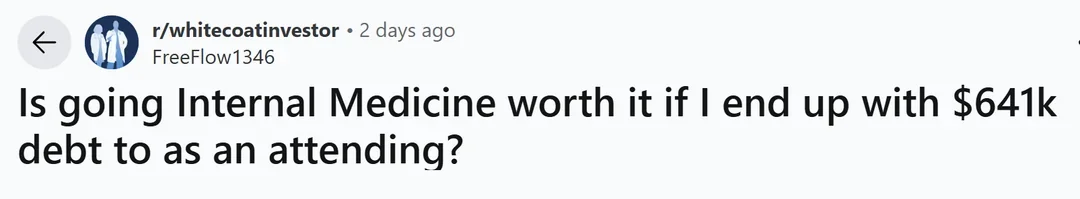

This delightful nocturnal journey was brought to you by a recent late-night spiral down a Reddit rabbit hole (here, and here, and there). The question of the hour? "Is $600k in debt too much to make medical school worth it if I want to go into internal medicine?"

bruh…what

I blinked. Then I read it again. Then I saw another post. "What about $700k?"

are you shitting me?

My friends, we have officially reached the point where the cost of becoming a doctor is approaching Spaceballs plaid levels. Unlike the movie, though, we can't hit the eject button.

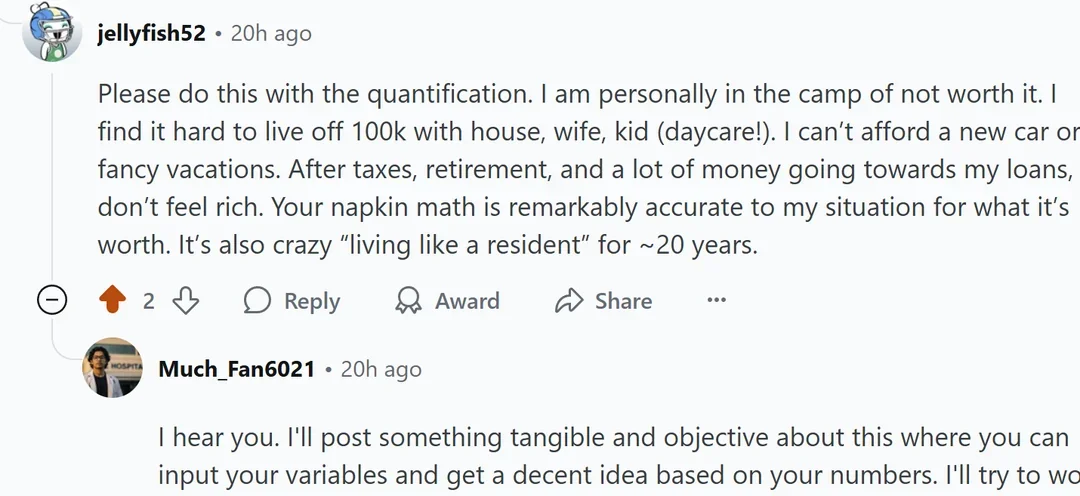

Anyway, the point of the post is that some users asked me to conduct a "quantified" analysis on how to decide on this fundamental question.

So I made School Debt Breaking Point Calculator. I plugged in my numbers (holy shyte man), and my laptop started smoking (no joke). I think it was trying to tell me something. Something along the lines of, "Have you considered a career as a med student Instagram influencer? The startup costs are significantly lower, and referral income is excellent."

And this is where I get to my favorite pastime, second only to diagnosing myself with rare, incurable diseases on 8-hour Anki sessions: railing against the establishment. Why do we need 4 years of medschool. Four years? In an age where you can learn how to perform an appendectomy from a YouTube tutorial (bet you this exists, I haven't checked), we're still stuck in a system designed to push us through MS4, 1/2 of which can be skipped (you're blowing many weeks doing nothing from what I've surmised, someone check me on this). Or even memorize useless minutiae (hi Krebs cycle that I'll never treat a patient with). But no, we must endure the four-year marathon, accumulating debt like a Kardashian accumulates Instagram followers.

Ok, enough ranting. You can select your specialities in the calculator, enter other loan-related information, and see how long it may take to pay off your loans. The assumptions are based on a loan you want to aggressively pay off, and I didn't bother with PSLF or IDR details (I made a separate calculator if you're interested). It should be evident how life is very different if you're an aspiring Orthopedic surgeon vs. a kind-hearted Pediatrician (or will be by MS3). The former's lifestyle goal is to have a garage that looks like a showroom for a luxury car brand and a weekend home in a state with no income tax (and trophy spouses) vs the chronically underpaid pediatrician who'll likely be paying loans till their kid is in medical school (at which point the cycle continues, JFC).

So tldr: "Is it worth it?" Is it worth a lifetime of debt for a lifetime of service? Is it worth sacrificing your financial future for the privilege of being woken up at 3 a.m. to be yelled at by a patient who thinks ChatGPT is a more reliable source of information than, you know, an actual doctor? I don't know the answer. But I do know this: the next time I'm on a hot date, and the bill comes, I'm going to pull out my student loan statement and say, "You got this one, right? I'm saving lives here."